Cashflow software software#

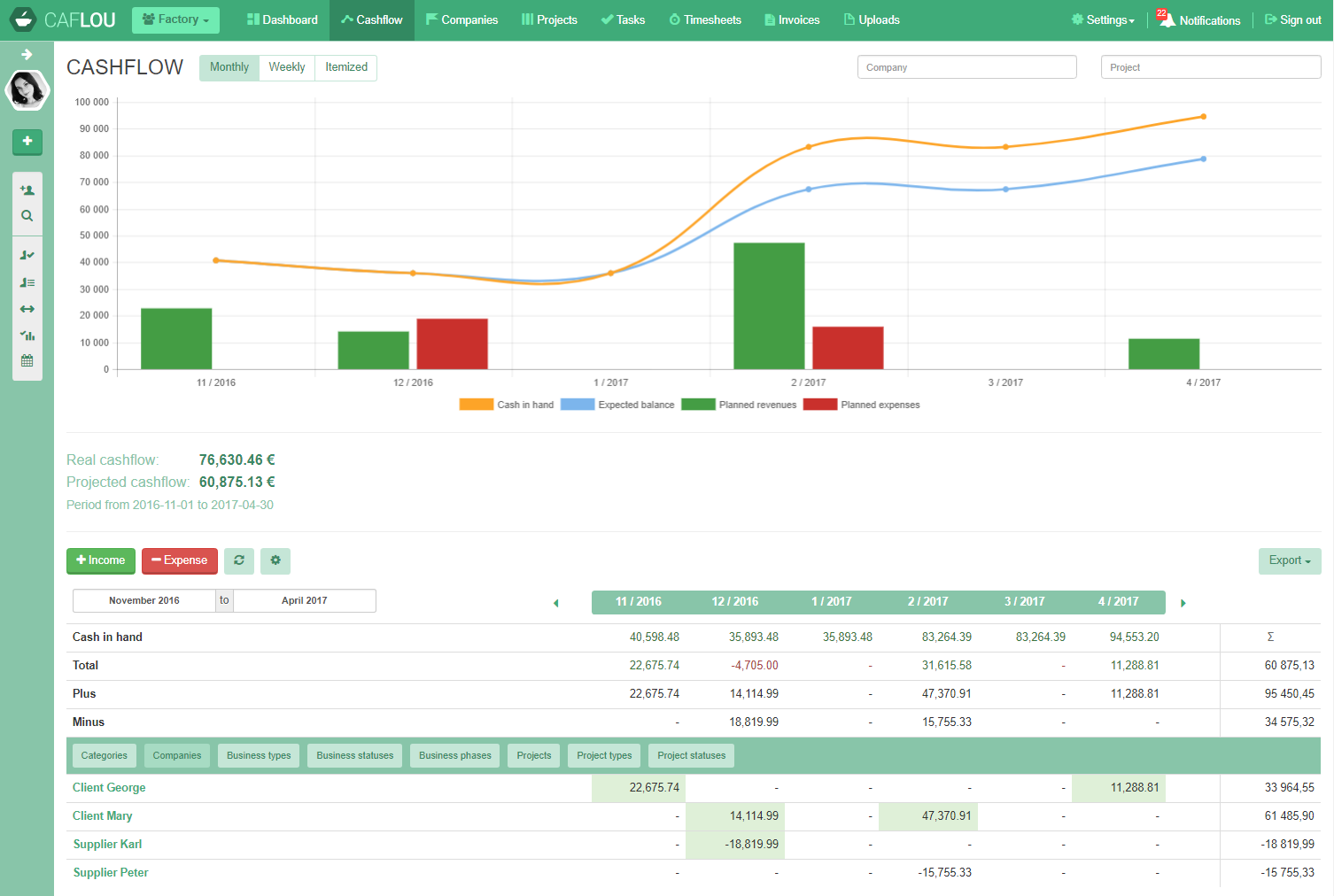

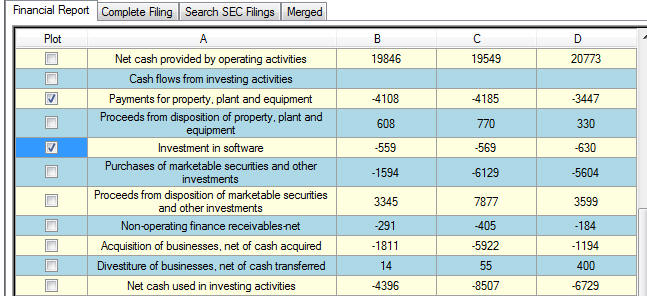

It is important to focus on the cash flow during these phases and use cash flow forecasting software to ensure proper visibility. A forecast needs input from a range of people within the company who can offer significant data and insightful observations that will deepen understanding of the factors that influence the statistics.ĭuring M&As, cash inflows and outflows not included on the income statement are reflected in asset and obligation balance changes. For instance, a significant acquisition might not accurately reflect typical flows, but other deviations might be less obvious.Įffective communication is one of the cornerstones of good cash flow forecasting. Historical data is critical to contextualize that data and screen out abnormalities. The treasury team can dig deeper into the data to fine-tune the forecast if they have excellent data management abilities. It is essential to gather the required data from relevant systems. The projection must be based on precise and timely data from bank statements, the company Resource Planning (ERP) system, or the Treasury Management System, and input from the pertinent business units. The objective may be to ensure enough cash on hand to pay obligations, lower external funding, maximize liquidity, or get visibility into covenant levels for expansion or M&A.įor efficient cash flow forecasting, solid technical knowledge is a requirement. Thus it is crucial to customize the method chosen following the demands and goals of the firm. When it comes to forecasting, there is no one-size-fits-all method. For cash-deficit companies, cash forecasting helps secure loans at low-interest rates, whereas for cash-rich companies, it helps in business growth. With cash forecasting, businesses can measure how much money is going out to fuel their growth and manage their assets. Why is forecasting important for any business model?

High turnaround time for creating consolidated central treasury forecasts delays reporting and decision making. Making strategic decisions becomes challenging without continuous data visibility or drill-down capability.

Spreadsheets cannot account for seasonality when making market opportunity estimates, which results in missed or delayed long-term investment and M&A possibilities.Hence, the quality of the data and cash forecasting declines. Data for forecasting is gathered from numerous teams throughout an organization who are in charge of distinct cash flows.There are a few factors that cause unpredictability and inaccuracy in forecasting cash flows, such as: Forecasting cash flow is cumbersome: Is it worth it? Bottlenecks in forecasting cash flows However, developing a cash forecast is challenging because it entails measuring, tracking, and making accurate assumptions about the organization’s growth. Cash flow forecasting is valuable in managing resources, improving business performance and returns, and scaling growth initiatives. One of the most important skills for business executives is managing cash flow effectively when running a company to ensure growth.

0 kommentar(er)

0 kommentar(er)